The “Choosing and Balancing a Checking Account Math Quiz” embarks on a captivating journey, inviting readers to delve into the intricacies of checking account management through an engaging and interactive quiz format. This quiz is meticulously crafted to assess understanding of fundamental concepts, empowering individuals to make informed financial decisions.

Throughout this quiz, participants will encounter a series of mathematical problems that simulate real-world checking account transactions. These problems cover a range of topics, including account selection, balance calculation, statement reconciliation, and more. By actively engaging with these problems, participants will not only test their mathematical skills but also gain a deeper comprehension of the practical applications of mathematics in managing their finances.

Understanding Checking Account Basics

A checking account is a type of deposit account held at a financial institution that allows individuals to deposit and withdraw funds easily. It functions as a hub for managing everyday financial transactions, such as making purchases, paying bills, and receiving deposits.

There are various types of checking accounts available, each with its own features and benefits. Some common types include:

- Basic checking accounts: Offer essential features like check writing, debit card access, and online banking.

- Interest-bearing checking accounts: Earn interest on deposited funds, providing a small return on savings.

- Premium checking accounts: Offer exclusive perks such as higher interest rates, rewards programs, and concierge services, often with higher monthly fees.

Checking accounts typically provide a range of services, including:

- Check writing: Allows users to make payments by writing checks.

- Debit card access: Enables users to make purchases and withdraw cash using a debit card linked to the account.

- Online and mobile banking: Provides convenient access to account information and transaction management through the internet or mobile apps.

- Direct deposit: Allows users to receive payments, such as salaries or government benefits, directly into their checking account.

- Bill pay services: Facilitates automatic bill payments from the checking account.

Factors to Consider When Choosing a Checking Account

When selecting a checking account, it is crucial to consider several key factors that align with individual financial needs and preferences.

- Monthly fees: Some checking accounts charge a monthly maintenance fee, while others offer free accounts. Consider the ongoing cost of maintaining the account.

- Interest rates: Interest-bearing checking accounts offer a return on deposited funds. Compare the interest rates offered by different accounts.

- ATM access: Determine the availability and convenience of ATMs associated with the checking account. Consider any fees for using out-of-network ATMs.

- Mobile banking capabilities: Evaluate the features and functionality of the mobile banking platform offered by the financial institution. Consider factors such as user-friendliness, security measures, and transaction limits.

Balancing different factors is essential. For example, an account with a higher interest rate may come with a monthly fee, while a free account may offer limited features or higher ATM fees. Consider the trade-offs and choose an account that best meets individual requirements.

Balancing a Checking Account

Balancing a checking account involves reconciling the account statement with the records of transactions made. It ensures that the account balance matches the actual amount of money available.

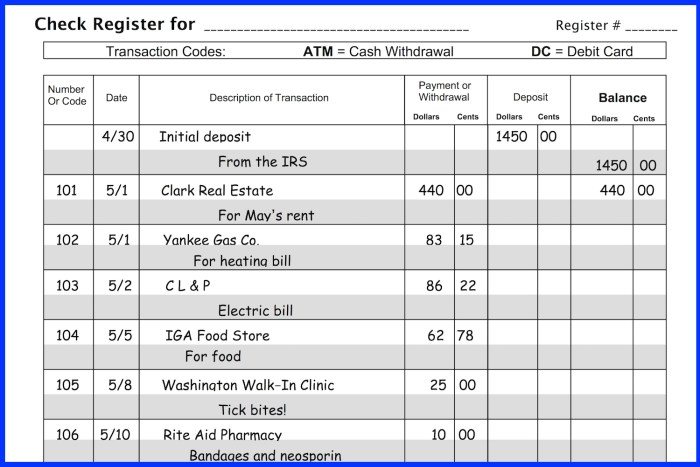

To balance a checking account, follow these steps:

- Gather the checking account statement and a list of all transactions made since the last statement.

- Compare the statement balance to the balance in your records.

- Identify any discrepancies and investigate the cause, such as missing or incorrect transactions.

- Make adjustments to your records to reflect the correct balance.

Regular account balancing is crucial for accurate financial management. It helps detect errors, prevent overdrafts, and maintain control over account activity.

Mathematical Concepts in Checking Account Management

Several mathematical concepts are involved in checking account management:

- Calculating account balances: Determine the current balance by adding deposits and subtracting withdrawals from the previous balance.

- Interest earned: Calculate the interest earned on deposited funds based on the interest rate and the time period.

- Overdraft fees: Calculate the fees incurred when withdrawing or spending more than the available balance.

Understanding these mathematical concepts is essential for effective checking account management and financial literacy.

Quiz on Choosing and Balancing a Checking Account

1. Which of the following is a common type of checking account that offers interest on deposited funds?

A. Basic checking account

B. Interest-bearing checking account

C. Premium checking account

D. Savings account

2. What is the purpose of reconciling a checking account statement?

A. To ensure the account balance matches the actual amount of money available

B. To identify fraudulent transactions

C. To earn interest on deposited funds

D. To avoid overdraft fees

3. Which of the following is a mathematical concept used in checking account management?

A. Calculating account balances

B. Interest earned

C. Overdraft fees

D. All of the above

FAQ Guide: Choosing And Balancing A Checking Account Math Quiz

What is the purpose of a checking account?

A checking account is a type of deposit account held at a financial institution that allows individuals to make deposits and withdrawals, typically using checks or debit cards. It is designed for everyday financial transactions, such as paying bills, making purchases, and receiving deposits.

What are the key factors to consider when choosing a checking account?

When selecting a checking account, it is important to consider factors such as monthly fees, interest rates, ATM access, mobile banking capabilities, and overdraft protection options. It is also essential to compare different accounts from multiple financial institutions to find the best fit for your individual needs and preferences.

How do I balance a checking account?

Balancing a checking account involves reconciling your account statement with your own records. This process includes comparing deposits, withdrawals, and other transactions to ensure that your records match the bank’s records. Regular account balancing helps you identify any errors or discrepancies and maintain accurate financial records.