Navigating the world of health insurance can be a daunting task, but the Pub. 974 Premium Tax Credit is here to offer a helping hand. This valuable credit can significantly reduce the cost of health insurance premiums, making it more affordable for individuals and families.

In this comprehensive guide, we will delve into the ins and outs of the Pub. 974 Premium Tax Credit, exploring its purpose, eligibility criteria, and how to maximize its benefits. Get ready to unlock the secrets of saving on health insurance and take control of your financial well-being.

Understanding the Pub. 974 Premium Tax Credit

The Pub. 974 Premium Tax Credit, often referred to as the Premium Tax Credit, is a government subsidy designed to help individuals and families afford health insurance coverage purchased through the Health Insurance Marketplace.

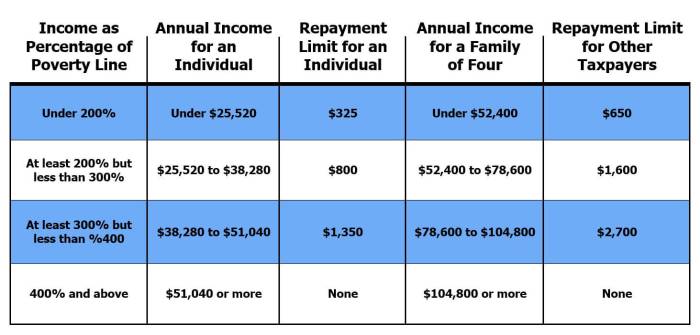

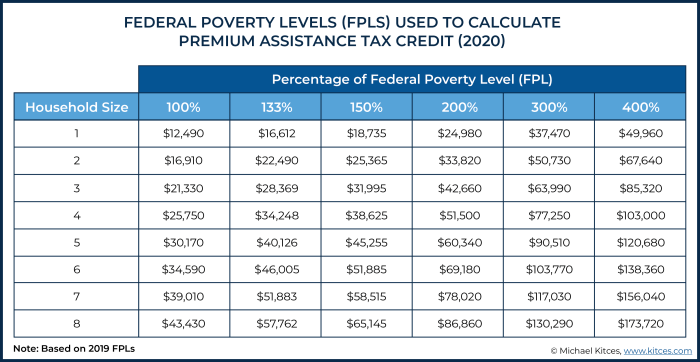

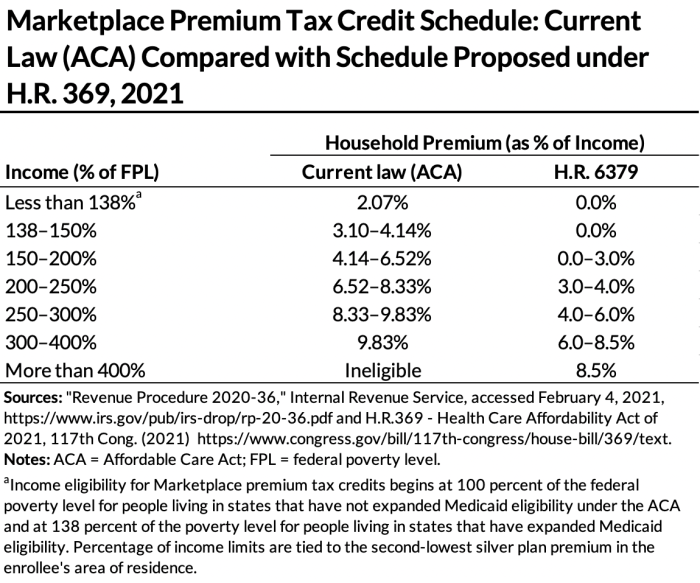

To be eligible for the Premium Tax Credit, individuals and families must meet certain income and other criteria. Generally, the credit is available to those who have household incomes between 138% and 400% of the federal poverty level (FPL).

Factors Affecting Eligibility

- Household income

- Family size

- State of residence

- Health insurance coverage status

It’s important to note that the income limits and other eligibility criteria may vary slightly from state to state. Individuals and families who are unsure about their eligibility for the Premium Tax Credit can use the HealthCare.gov eligibility tool or consult with a tax professional.

Calculating the Pub. 974 Premium Tax Credit

The Pub. 974 Premium Tax Credit is calculated based on a formula that takes into account several factors, including your income, family size, and the cost of health insurance coverage. The credit amount is designed to help you afford health insurance coverage through the Health Insurance Marketplace.

Formula for Calculating the Pub. 974 Premium Tax Credit

Premium Tax Credit = Maximum Credit Amount

(Adjusted Gross Income x Applicable Percentage)

Where:

- Maximum Credit Amount:The maximum amount of the credit you can receive, based on your family size and income.

- Adjusted Gross Income (AGI):Your total income before certain deductions and adjustments.

- Applicable Percentage:A percentage that varies depending on your income and family size.

Using the Pub. 974 Premium Tax Credit

The Pub. 974 Premium Tax Credit is applied directly to your health insurance premiums, reducing the amount you owe each month. You can use the credit in two ways:

Through advance payments, Pub. 974 premium tax credit

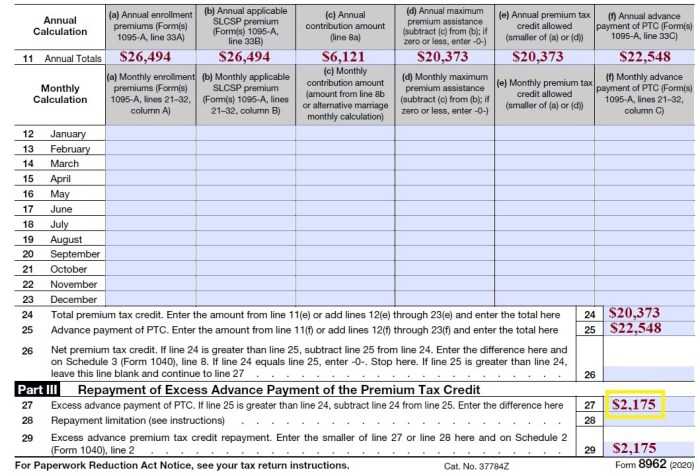

If you qualify for the credit, you can choose to have it paid directly to your health insurance company in advance. This will lower your monthly premiums. To do this, you’ll need to complete Form 8962, Premium Tax Credit, and submit it to your insurance company.

As a tax refund

If you don’t want to receive advance payments, you can claim the credit when you file your taxes. When you do this, the credit will be applied to your tax bill, reducing the amount you owe or increasing your refund.

Here are some examples of how the Pub. 974 Premium Tax Credit can reduce the cost of health insurance:

- If you have a monthly premium of $500 and qualify for a credit of $200, your monthly premium will be reduced to $300.

- If you have a yearly premium of $6,000 and qualify for a credit of $1,000, your yearly premium will be reduced to $5,000.

- If you claim the credit when you file your taxes and owe $500 in taxes, the credit will reduce your tax bill to $0.

The Pub. 974 Premium Tax Credit can make health insurance more affordable for many people. If you think you may qualify, it’s worth taking the time to apply.

Reporting the Pub. 974 Premium Tax Credit

The Pub. 974 Premium Tax Credit is reported on Form 8962, Premium Tax Credit. This form is used to calculate and report the amount of the premium tax credit that you are eligible to receive. You must file Form 8962 if you received advance payments of the premium tax credit during the year.To

complete Form 8962, you will need to provide information about your income, family size, and health insurance coverage. You can find instructions for completing the form on the IRS website.It is important to complete Form 8962 accurately. If you make a mistake on the form, it could delay your refund or result in you having to pay additional taxes.If

you do not report the premium tax credit accurately, you may have to repay some or all of the credit that you received. You may also be subject to a penalty.

Common Errors When Completing Form 8962

Some of the most common errors that people make when completing Form 8962 include:* Entering the wrong income amount

- Not reporting all of your family members

- Not reporting all of your health insurance coverage

- Making math errors

Consequences of Not Reporting the Credit Accurately

If you do not report the premium tax credit accurately, you may have to repay some or all of the credit that you received. You may also be subject to a penalty. The penalty for not reporting the credit accurately is 1% of the amount of the credit that you should have reported, for each month that the credit is not reported.

To learn more about the pub. 974 premium tax credit, it’s worth checking out resources like abeka world history test 3 , which provides valuable insights into the topic. Additionally, the pub. 974 premium tax credit can be a helpful resource for those seeking further information on this subject.

Additional Considerations for the Pub. 974 Premium Tax Credit

Navigating the Pub. 974 Premium Tax Credit can be straightforward with the right resources and understanding. Here are additional considerations to keep in mind:

Resources for Understanding and Using the Credit

Numerous resources are available to assist individuals and families in understanding and utilizing the Pub. 974 Premium Tax Credit. The IRS website provides comprehensive information, including publications, forms, and online tools. Additionally, many community organizations, legal aid societies, and tax preparation services offer free or low-cost assistance.

Common Misconceptions and Frequently Asked Questions

To ensure accurate understanding and utilization of the credit, it’s essential to address common misconceptions and frequently asked questions. Some individuals mistakenly believe they are ineligible for the credit due to income limitations, while others may not realize the credit is refundable, meaning they can receive a refund even if they owe no taxes.

Recent Changes or Updates to the Program

The Pub. 974 Premium Tax Credit program has undergone changes and updates over time. It’s important to stay informed about these modifications to ensure you are receiving the maximum benefit available. Recent changes include adjustments to income eligibility limits and the availability of advance payments of the credit.

General Inquiries

What is the purpose of the Pub. 974 Premium Tax Credit?

The Pub. 974 Premium Tax Credit helps eligible individuals and families reduce the cost of health insurance premiums by providing a tax credit that can be used to offset the premiums.

Who is eligible for the Pub. 974 Premium Tax Credit?

To be eligible for the Pub. 974 Premium Tax Credit, you must meet certain income limits and have health insurance coverage through a Marketplace plan.

How do I calculate the amount of the Pub. 974 Premium Tax Credit I can receive?

The amount of the Pub. 974 Premium Tax Credit you can receive is based on your income, family size, and the cost of your health insurance plan.

How do I use the Pub. 974 Premium Tax Credit?

You can use the Pub. 974 Premium Tax Credit to reduce your monthly health insurance premiums or receive a refund when you file your taxes.